Many of the comments we received from clients, friends and acquaintances express frustration with the current economic and political environment investors find themselves in, in 2016. The resurgence of volatility in the post QE world and uncertainty with many parts of the globe politically and economically, exacerbated by the impact of plunging oil prices along with other commodities, seems at odds with the healthy, growing global economy. One of the quotes frequently attributed to Warren Buffett is "Investing simple but not easy'. My interpretation of his comment is that many things get in the way of investing; Investor psychology, fuzzy data, costs and sometimes just silly thinking.

Successful investing requires understanding what matters, and at the same time, recognizing what an investor can control. The intersection of these two concepts are important distinctions to be made when making portfolio decisions. For example, the ability to control what the economy does or doesn't do, whether the various market places for investments will be positive or negative, what inflation will be and what new geopolitical events may pop into our world are impossible to know with any degree of precision. Yet we can't get enough of those opining on their view of these same topics. If they clearly knew they would most likely keep their opinions private in order to capitalize on the knowledge or "secret sauce'.

While the previous paragraph might possibly lead one to conclude that this information is useless, it is not. It is helpful in construction of a portfolio to be based on things we can, in fact, control. These four controllable factors can increase the effectiveness of a portfolio and its overall probability of success. These controllable factors are:

- Valuations

- Costs

- Volatility

- Tax Effectiveness

Valuations

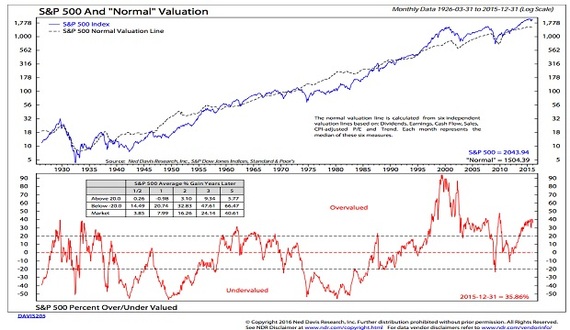

Despite whether we are buying a private residence, business or other type of investment, common sense tells us that buying an asset at an expensive price will likely lead to a less than favorable outcome. At the same time buying assets at a reasonable or possibly undervalued price will most likely lead to favorable outcomes. The chart below by Ned Davis Research shows the impact that valuation has on returns using a mix of 5 valuation metrics. Note the lower clip of the chart and the red line as it fluctuates between undervalued, fair value (between the upper and lower dashed lines) and overvalued. The 'box' in the lower clip indicates how the S&P 500 has delivered returns in the past, on average, when valuation metrics are at certain levels. The returns are cumulative not annualized. Valuations matter and have a large impact on what reasonable returns might be expected. Of course, this is not a guarantee of what results will likely be, but does provide some important clues. Does this mean that the S&P 500 should be totally avoided? No, but it does suggest that overweighting this singular asset type may not be helpful in constructing a high probability portfolio. Other asset classes may provide better risk return characteristics and would likely deserve a higher relative weighting from your base allocation model.

Costs

Of course, costs are a drag on portfolio performance and reasonable care should be taken to make sure the costs incurred are not only reasonable but deliver value. If traditional core equities will deliver mid-single digit returns, active managers must deliver a significant "excess return" to deliver value over a passive index fund or ETF. If the lower return scenario is accurate, then the excess returns an active manager must deliver to compensate for their higher fees, is a higher percentage of the gross return than they previously need to deliver. For example, one percent off a ten percent gross return is 10% of the return. Likewise a one percent fee on a 5% gross return is twenty percent of the return. The burden of proof is on the active manager but the hill to climb for them has become much steeper in the likely low return environment for long-only equity strategies.

Volatility

A reader may quickly come to the opinion that "I have no control of stock market volatility" and from that perspective they are correct. Long-only equity strategies are volatile, there is never a good time for down drafts in the market and drawdowns come usually at the worst time. As if there was ever a good time! Investing is not necessarily restricted to long-only stocks, bonds and cash fortunately. Well-selected non-traditional strategies can reduce fluctuation in the portfolio dramatically and preserve capital during stressful times. Strategies such as market neutral, long-short, and managed futures add value by muting the impact of portfolio volatility. Absolute return strategies including private lending, real estate and private equity provide additional characteristics and engines of return to add to the effectiveness of your portfolio.

Tax Effectiveness

No one likes to pay taxes but I prefer to use "tax effectiveness" over the term "tax efficiency". Tax efficiency implies to reduce taxes to the absolute lowest level they can be. Unfortunately this too often leads to good short term but lousy long-term decisions when it comes to taxes. For example, tax loss harvesting each year can lead to lowering the overall cost basis of the portfolio. While deferral can be good, one of the items we will likely not have control over is the level of taxation in the future. The lowered tax basis in the portfolio also reduces investment flexibility in the future by having less "taxed" capital available to meet current needs or to reallocate portfolio positions. "Tax effectiveness" focuses instead on realizing an attractive "after tax" return on capital while preserving the maximum flexibility longer term.

Summary

Investors who focus on the things that matter and the factors they have control over, can then filter out the increasing level of noise that exists in the investing universe. The increased focus on the four factors within investors control will lead to portfolios that will have increased impact, satisfaction and results.

To learn more about Bob Klosterman, view his Paladin Registry profile.

Originally posted on PaladinRegistry.com

About the Author: Bob Klosterman CFP® is CEO and Chief Investment Officer of White Oaks Investment Management, Inc. and its predecessor R.J. Klosterman & Co, Inc. Bob has been a Certified Financial Planner licensee since 1989. He has been listed as one of the Top 250 Financial Advisors in the United States by Worth Magazine. He has also been recognized as one of the top 150 Financial Advisors by Mutual Fund Magazine, Medical Economics and Bloomberg's Wealth Manager Magazine. Bob's published quotes appear frequently in dozens of local and national publications, including USA Today, the New York Times, Minneapolis Star Tribune, CFP Today, Barron's and Fortune. Follow Bob on Twitter @bobklosterman